San Francisco condos are the Bay Space’s weakest actual property market. So why aren’t house costs dropping extra?

San Francisco is the weakest spot in the Bay Area’s most booming real estate market, and the condominium segment is the weakest of them all.

Inventories have grown faster than sales, and price cuts – mostly in the condominium segment – “have hit very high numbers,” said Patrick Carlisle, chief market analyst for real estate agency Compass. Why hasn’t the average price of a condo in San Francisco dropped more?

The average price for a condo in San Francisco fell to $ 1.25 million in the third quarter, a decrease of only 2% from the third quarter of 2019, according to Carlisle. The average price for a single family home rose 5.2% to $ 1.66 million.

Main reason condominiums stopped falling: sales of two-bedroom units rose significantly year over year from 330 to 330, while one-bedroom condominium sales fell slightly from 183 to 186.

“The surge in two-bedroom sales has increased the overall average sales price for condominiums,” said Carlisle. If you look at one and two bedroom units separately, their average prices fell 6.6% and 6.5%, respectively, “which sounds much truer”.

This shows why it can be misleading to just look at average prices, where half the houses sell for more and half for less.

Carlisle found “a similar dynamic in terms of median home sales prices in the Bay Area for the third quarter”. The average size of homes sold in the Bay Area in the third quarter rose virtually everywhere, in the 5% to 10% range in general. Larger homes sell for more money, which increases the median selling price. “It doesn’t reflect market values or what an individual home could sell.

Although market values have risen in most areas, “a significant portion of the median price increases were simply due to sales of larger homes,” said Carlisle. “Wealthy buyers have played a bigger role in the market since the pandemic.” Its data is based on sales reported to a multiple listing service.

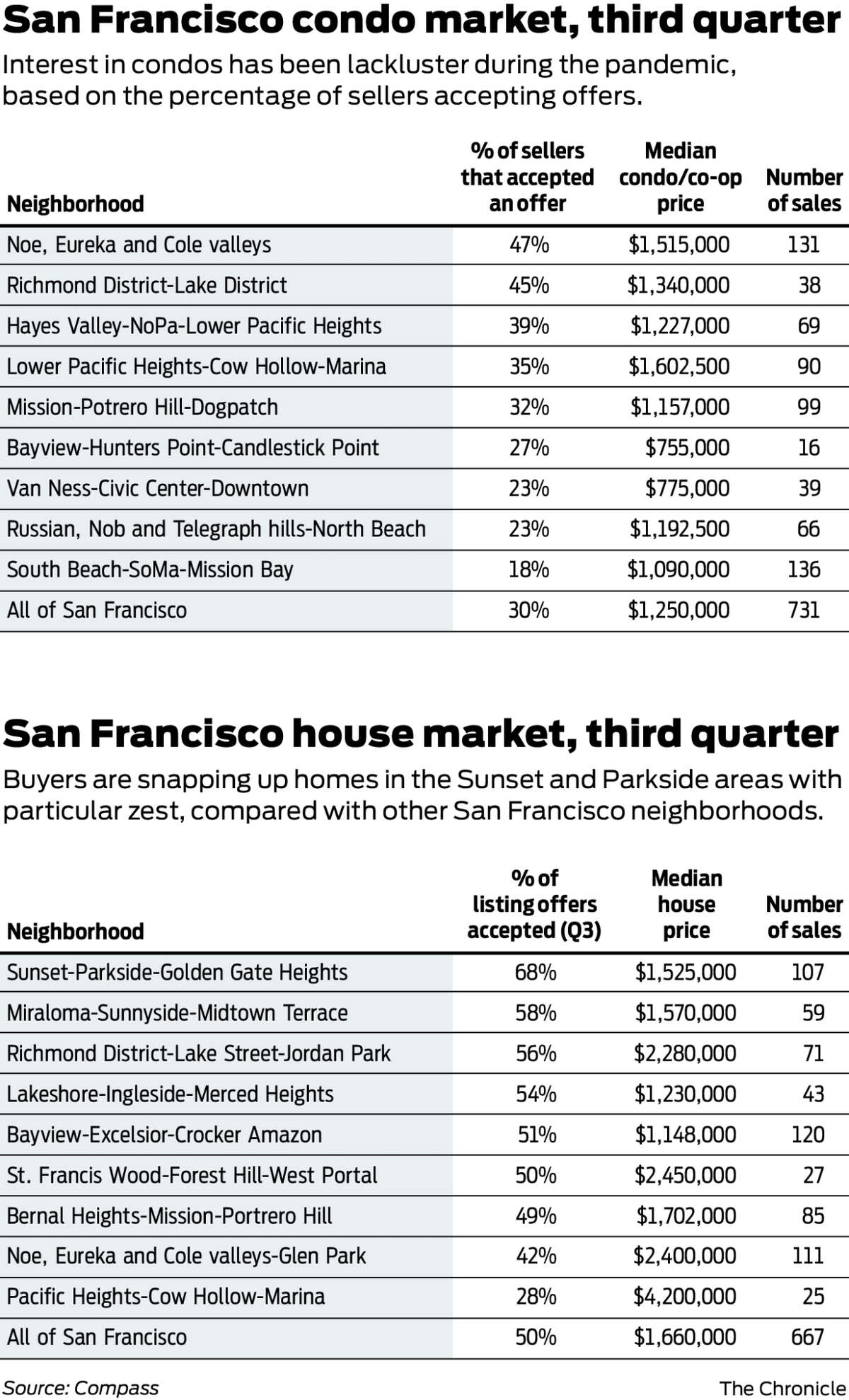

Even in a soft market, buyers face stiff competition in some segments. One way to measure “sharpness” is to look at the percentage of houses that contract. This means that the seller has accepted an offer. With this move, the hottest condominium markets in San Francisco in the third quarter were Noe / Eureka / Cole Valleys (47% adoption rate), followed by Richmond District / Lake Street (45%).

The coolest were South Beach / South of Market / Mission Bay (18%) and Russian / Nob / Telegraph Hills and Van Ness / Civic Center / Downtown (23% each).

For single-family homes, Sunset / Parkside / Golden Gate Heights was the hottest neighborhood in San Francisco, where 68% of homes were contracted in the third quarter. The coolest was Pacific Heights / Cow Hollow / Marina (28%).

Another measure of timeliness is the average amount by which the selling price exceeds the original list price, also known as overbidding. Again, the Sunset / Parkside neighborhood was the leader in single-family homes in San Francisco. Buyers paid an average of 9% more than list price in the third quarter. The coolest was Pacific Heights / Presidio Heights / Cow Hollow / Marina, where the average shopper paid 4.6% less than asked.

Sunset / Parkside “is extremely hot,” said Agent Jason Chan of Barbco Real Estate. “I received an average of 10 or 20 offers in my offers (there). Usually they go 40% beyond asking. “He admitted that realtors in town rate houses way below market value because if they value them at market value or slightly above, they” sit in the market for weeks or months. “

He listed a small house in 2101 Wawona, Parkside, for just under $ 1.1 million. It received 22 offers and was sold for $ 1.5 million.

Compass agent Yesenia Rogers said Sunset / Parkside is a great alternative to the suburbs for people who mostly live in their homes during the coronavirus pandemic and want a yard and space for an office or classroom. “Here you can get a single-family home in the $ 1.5 million range that has space, three bedrooms, a back yard in a nice, safe community,” she said.

Rogers works with three buyers who are “actively writing offers” in this area. All of them rent out condominiums and at some point want single-family homes for children. “These are people who believe in San Francisco, believe that the city will return and maybe not like it used to, but San Francisco remains a good investment.” Some want to stay close to relatives in the city.

Last week, their buyers bid on one home with 12 offers and another with 20 offers. “San Francisco has a lot of inventory in the market,” and the sales “are pretty hot and cold,” said Rogers. “I don’t think (sunset) is an area where you get hit all the time. But it’s competitive compared to other parts of the city, she said: three-bedroom houses on one level will see a lot of offers.

While the average single-family home sold 2.4% more than the asking price in the third quarter, the average San Francisco condo sold 2.6% less. The best neighborhood to live in was the Richmond borough, where the average unit sold straight for price. The weakest was Russian / Nob / Telegraph Hills / Financial District, where the average unit sold for 7% less than asked.

Surprisingly, some parts of the Bay Area that were hardest hit by forest fires and power outages were among the “hottest” in the third quarter.

Carlisle compared the percentage of homes (single-family homes and condos combined) signed in the third quarter of 2020 to the same quarter last year for the Bay Area and some surrounding counties.

In the third quarter of this year, Solano, Contra Costa, and Alameda were the districts with the largest proportion of homes under contract.

But the boroughs that saw the biggest percentage change in that number year over year were Monterey, Santa Cruz, Napa, and Sonoma. This is another way of measuring sharpness.

“San Francisco is the only county that has seen a decline,” said Carlisle. The proportion of homes accepting an offer fell from 41% last year to 36% this year.

Kathleen Pender is a columnist for the San Francisco Chronicle. Email: kpender@sfchronicle.com Twitter: @kathpender