California residence costs hit a brand new report. How greater might they go?

Home prices in California have become so high that even “low-priced” homes are outside the reach of many residents.

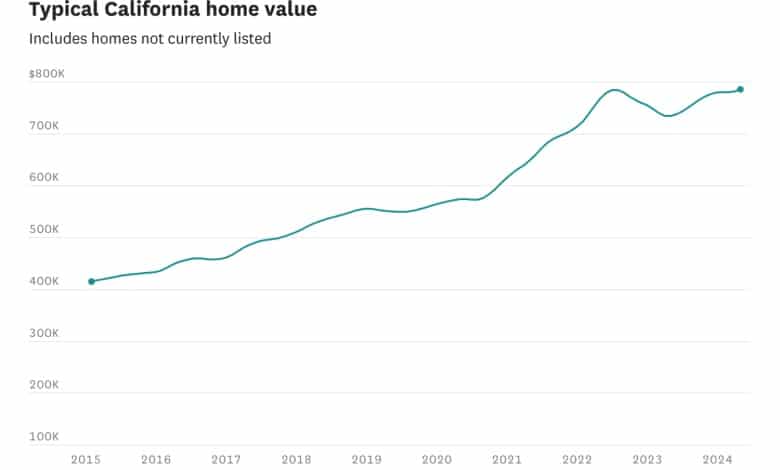

Lea Suzuki/Lea Suzuki/The ChronicleCalifornia’s home values hit their highest-ever levels in April, reversing a dip caused by mortgage rate hikes two years ago.

The typical California home was valued at $786,000, according to data from real estate brokerage site Zillow. That just barely beat out the previous record of $785,000 in July 2022, though that month still holds the record in inflation-adjusted terms.

The typical United States home also reached its highest-ever value in April at $359,000.

Article continues below this ad

The median price for homes that actually sold in April was also a record of about $853,000, according to real estate brokerage site Redfin, up from the previous high of $838,000 two years ago. Those figures are higher than Zillow’s home value estimate, which could indicate that the types of homes selling are of a slightly higher quality or size than the typical property.

How (un)affordable are homes now?

Home prices are so high that even “low-priced” homes — which Zillow defines as the typical value for homes in the 5th to 35th percentile range — are outside the reach of many residents.

In order for a household to get a mortgage on the typical low-price home and pay 30% or less of its income in loan payments, a household needs to make at least $143,000 a year, according to the state Legislative Analyst’s Office. In 2014, that threshold was just $51,000.

Article continues below this ad

California’s median household income was only $92,000 in 2022, according to U.S. Census Bureau data.

Unable to afford homes in coastal areas like San Francisco, many first-time home buyers turn to inland regions such as the San Joaquin Valley, said Hans Johnson, a demographer with the Public Policy Institute of California. Cities like Lathrop, which is building thousands of for-sale homes, have seen their populations rise rapidly.

But those places aren’t nearly as affordable as they once were. In 2012, the typical home value in San Joaquin County was about the same as the national figure, Johnson pointed out. Now, the county’s typical home is worth about $180,000 more than the national figure of nearly $360,000.

“The places people used to be able to go to (for cheaper housing) are pricing some people out now in a way that didn’t used to happen so much,” Johnson said.

Article continues below this ad

Why are prices so high?

Home prices are up for the same reason they usually are — there’s just not enough houses for everyone who wants to buy one, said Orphe Divounguy, senior economist at Zillow.

There were more than 83,000 homes for sale in California in April, according to Redfin data. While that was higher than a year ago — after interest rate hikes slowed the market — it was 36% lower than the April 2019 total, when 131,000 homes were for sale.

In contrast, there were 146,000 homes for sale in Texas in April 2024, higher than its April 2019 number.

Article continues below this ad

California’s slow rate of housing production has also contributed to its affordability crisis. While the state has ramped up the number of permitted homes, it still lags far behind officials’ goals. And most new homes are rentals, Johnson said.

Stagnant mortgage rates have also kept homes off the market, with many homeowners reluctant to give up their current mortgage rates, which are often lower than the rates they’d get if they sold their home and bought a new one.

Mark McLaughlin, chief real estate strategist at Compass, said he doesn’t expect the Federal Reserve to lower interest rates until at least the fourth quarter of 2024. Even then, he added, it’s unclear how much rates could fall.

“I think we all need to get used to these markets,” he said.

How high could prices get?

California’s prices could climb further still during the summer, which is typically when the most people look to move.

Article continues below this ad

But Divounguy said the national surge in prices might taper off over the next year, as some possible sellers learn to live with the higher rates of a new home. The additional inventory could bring prices down a bit, but that depends on how many homeowners decide to sell.

It’s also possible that some California residents will simply give up on buying a house here. Johnson said that high housing costs have contributed to the number of people leaving California — though he noted that prices are also going up in other states.

Within California, there are some examples of housing costs slowing down or declining once prices exceeded what many buyers were willing to pay. San Francisco’s home values remain below their previous peak, Johnson pointed out, dipping slightly over the past year. Santa Clara County’s values are also lower than their 2022 heights, though its proximity to Silicon Valley wealth has driven prices upward in the past year.

Even with people leaving the state for Florida or Texas, many people still want to buy a home in California, housing experts said. As long as that’s true — and without a surge in supply — April isn’t likely to be the last time California sets a record.

“Affordability is definitely an issue, but I don’t see any compromise coming out of the housing market,” McLaughlin said.

Reach Christian Leonard: Christian.Leonard@sfchronicle.com