ULTA Magnificence: One other Likelihood To Accumulate (NASDAQ:ULTA)

Frazer Harrison

Ulta Beauty (NASDAQ:ULTA) is America’s largest beauty retailer with around 1400 stores across the US. The company is specialized in selling beauty products such as cosmetics and skincare. For more background information on the company, please refer to my original bull thesis: “Time to Re-Accelerate“.

ULTA is at a crossroads where the company either remains as a US-focused retailer or whether it grows into a global business to expand its business internationally. The market is uncertain about ULTA’s future and its growth.

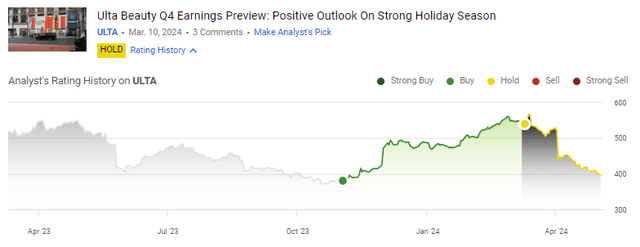

Over the past year, the stock has been a wild ride for investors. Trading between lows of under $400 and highs of above $500. We rate the company as a “buy” as it recently dipped again under our $400 buying price.

Previous Ratings (Seeking Alpha, 2024)

My thesis is that the pullback is excessive, and the ULTA is again undervalued, trading under $400 per share. Not much has changed since my original thesis, but the market is impatient. The company warned investors about a bad first quarter, but as long-term investors, we should look beyond the next quarter.

I believe that the re-acceleration of growth will still happen because of international expansions, but that the timing of this shift will be in FY2025 rather than 2024. Planning and preparing international expansion takes time, but international expansion will already start to contribute to significant growth during next fiscal year. The short-term weakness in ULTA’s share price is therefore an opportunity that provides a good entry point for value investors.

Recent Developments

The company reported FY2023 results in March, beating estimates, with strong Q4 performance during the holiday season. However, guidance for FY2024 was rather weak. Investors expected to see a large increase in growth estimates because of international expansion plans; significantly expanding the business beyond the US, which only makes up one fifth of the global beauty market. The expectations were high leading up to the Q4 conference call and investors were disappointed, we’re now right back to where we started at $400.

The company showed good performance in Q4 FY2023. ULTA beat estimates, and they did announce plans to expand internationally to Mexico in a joint venture together with Grupo Axo. However, investors did not respond well to this news. The plan was unclear and lackluster. ULTA did not provide a lot of information about it, citing competitive reasons, and the expansion is delayed until 2025. Moreover, competition is heating up domestically that could pressure margins. Finally, ULTA’s guidance for FY2024 was relatively weak; they projected a soft first quarter but a stronger second half of the year.

Planned International Expansion to Mexico

During the FY2023 conference call, the CEO provided a short summary of the international expansions plans. He didn’t share much detail:

The Mexican beauty market is sizeable, growing, and has significant beauty whitespace. Our research suggests there is a healthy awareness of the Ulta Beauty brand with local beauty enthusiasts, and we also see strong engagement in our stores located geographically adjacent markets. After extensive evaluation, we’ve prioritized a partnership, asset-light approach to enable us to move quickly, and I am excited to announce we have formed a joint venture with Axo, a highly experienced international operator of global (international) brands, to launch and operate Ulta Beauty in Mexico in 2025. As a result of this approach, we do not expect this venture to be material to our financials in fiscal 2024. (ULTA beauty & Grupo Axo, 2024).

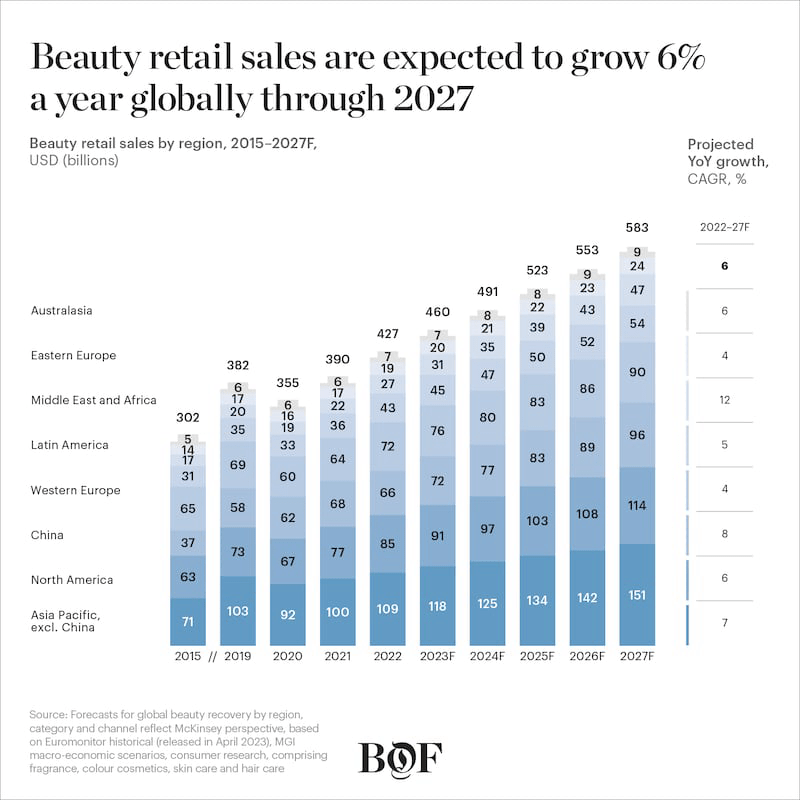

The announcement was a bit underwhelming as it only Mexico and few details were shared. Moreover, the expansion has been delayed by one fiscal year. However, after testing the market in Mexico, ULTA could expand to other Latin American markets through their strategic partnership with Grupo Axo who operate retail stores across a number of different Latin American markets. Similarly to Mexico, Ulta could repeat this formula with different partners to scale rapidly in Latin America with relatively low capital intensity. Ulta does not have to physically build-out new stores that require a lot of capital investment, but they can franchise or collaborate with existing retail operators. The potential of international beauty markets is still very large, as expanding to Latin America would approximately double their total addressable market.

Global Beauty Markets (BOF, 2023)

The Beauty Market in Mexico

The total Mexican beauty market is valued around $10b. With a population of 130 million people who are steadily improving their standard of living, Mexico provides ample room for future growth. Estimating the potential of The Mexican beauty market, using the same store density of 1 store per 200.000 people in the US, Mexico could be a market for about 650 new ULTA stores.

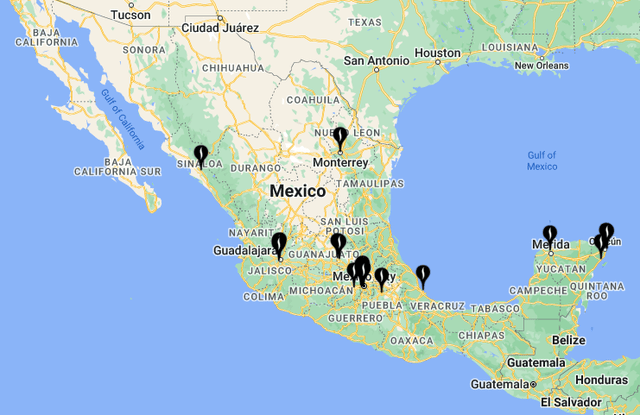

ULTA’s main competitor, Sephora, is already active in Mexico, so it will not be a walk in the park for ULTA to take these markets. However, Sephora still has a relatively small presence in Mexico, with about 40 stores across the whole country. Sephora is more focused on Asia and Europe, so expanding into Latin America could be a good option for ULTA to avoid strong competition.

Other Mexican beauty market competitors are supermarkets and department stores like Liverpool, Soriana, and Walmart subsidiary Superama. As a competitive advantage against these companies, Ulta offers a superior in-store experience with services, and it is specifically focused on beauty products. Specialty retail stores attract more beauty enthusiasts who are willing to spend more, versus general retail like department stores or pharmacies.

Sephora locations (Sephora, 2024)

Moreover, according to ULTA’s research, Western women are generally less interested in beauty products as compared to (perhaps more feminine) Latin American women. Similarly, in academic research, it has been shown that Latina women generally use the most make-up compared to other ethnicities.

ULTA’s choice to expand towards Latin America, instead of Canada or Europe, is therefore a strategic one that is backed by their own market research and avoids markets with a lot of existing competition. I have confidence that Ulta will be able to capture a significant portion of the Mexican beauty market. When they succeed in Mexico, I expect them to continue expanding further into other Latin American countries to grow the business long-term.

Financial Outlook and Valuation

As noted before, Ulta provided soft guidance for Q1, but the stock market should look further than one quarter ahead. EPS estimates predict an 8% decline YoY for Q1. This bad outlook for Q1 might have caused people to sell.

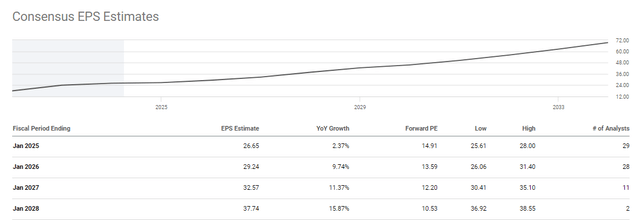

Consensus EPS estimates (Seeking Alpha, 2024)

In line with consensus, we predict a mediocre FY2024 (2%-5% growth) and then a re-acceleration of growth in FY2025 and beyond (10% growth). This is consistent with my first article, but the timing of the re-acceleration has been pushed back to FY2025. The mediocre FY2024 expected numbers provide an entry point for long-term value investors who look more than one year ahead.

The forward P/E for FY2024 is only 15, and we expect margins to improve in FY2025 as well as a multiple expansion when the growth rate increases in FY2025 due to international expansion. The first half of FY2024 is a rather weak period and could therefore be a good opportunity to accumulate shares.

Long-term, we expect a multiple expansion as ULTA beauty grows internationally to 20 times forward earnings, which implies a price range of $500 to $600 dollars per share in FY2027, up about 40% from now.

Conclusions

I believe that ULTA has capable management which does not let itself get pulled into the craziness of Wall Street. The CEO takes his time to plan and maintain his composure. Even though the international expansion will take time and is delayed, it will still happen, and I expect that ULTA will become a global player in the beauty market.

As a result, the company will be larger in the future than it is now, and therefore more valuable. The short-term action in the share price in recent months provides a sneak peek of what will happen in FY2025 and beyond. We rate a “buy” and we will add to our ULTA position for a margin of safety price below $400 per share.