Ulta Magnificence: Low-cost Valuation In An Unsure Economic system, I might Maintain (NASDAQ:ULTA)

Brett_Hondow

I rate Ulta Beauty (NASDAQ:ULTA) as a Hold given its cheap valuation compared to competitors, uncertainty in the consumer economy, and pessimistic view on category growth.

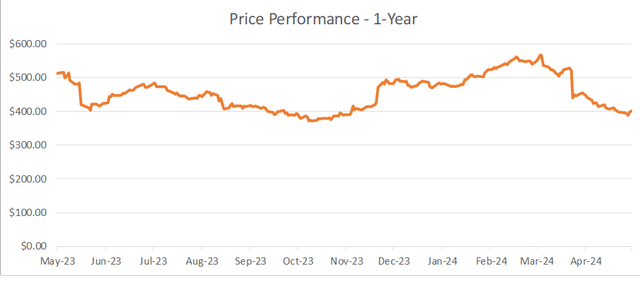

Shares of Ulta are currently trading closer to their 52-week low of $368.02 than their 52-week high of $574.76. To summarize Q1 earnings, diluted EPS was $6.47 per share, ahead of analysts’ consensus of $6.28 per share. Revenue missed expectations at $2.73 billion, missing estimates by $645K.

There is significant upside to be had at the current share price, given the announcements to expand the already solid business into new geographies and consumer segments. In addition to the recent Ulta Mexico announcement, CEO David Kimbell delivered news of new exclusive emerging brands in their pipeline, and the retrofitting of various fulfillment centers to improve operating efficiency. The reality is, Ulta is a highly dependable, established company with an average revenue growth rate of 23% over the past three years.

What Happened In Earnings?

Beyond the previously discussed metrics, Kimbell announced comparable (same-store) sales increased 3.5% driven by high single-digit growth from digital channels. Exclusive brands such as Bioma, Bubble, and Good Molecules delivered strong growth, while dermatologist-recommended brands including La Roche-Posay, Dermalogica, and Cetaphil continued to appeal to consumers.

Ulta additionally experienced growth in various platforms. Ulta surpassed 1 million followers on TikTok recently while experiencing a 30% increase in member utilization for the Ulta app. Ulta’s app continues to drive strong growth for the firm, with 57% of e-commerce sales in Q1 coming from it. From a store perspective, Ulta opened 33 new stores and renovated 25 in FY 24, while opening 12 more in Q1 FY 25 alone. As previously mentioned, Ulta also opened 155 more Ulta Beauty at Target locations in FY 24, strengthening their partnership to 510 total shops.

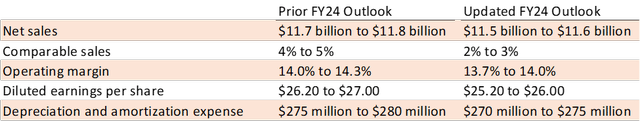

However, Ulta did lower guidance for FY 24 on their net sales, operating margin, and EPS to $11.5 to $11.6 billion, 13.7% to 14.0%, and $25.20 to $26.00 respectively. This might signal signs of uncertainty from Ulta management on how the company might perform in a turbulent economy.

The Bull Case

Could An Uncertain Economy Help?

If there is one thing most economists agree on, it is the fact that there is major uncertainty in this economy. A recent McKinsey article highlighted that consumers expect to spend more on essentials such as gasoline and groceries over the next few months, with less spent on consumer discretionary items. However, investors who read between the lines might see the value proposition this presents for Ulta. The same McKinsey article stated that out of all possible categories, personal beauty is in the current top five in terms of intent to splurge by consumers. Furthermore, while consumer appetite has dwindled for semi-discretionary products with some categories such as fitness declining by as much as 9% QoQ, skin care and makeup is down 1% QoQ, showing the industry may show more resistance to a struggling consumer economy than some other sectors.

Additionally, Ulta presents a unique situation in the Beauty industry where it can attract consumers seeking both premium and value products. As many followers of the company know, Ulta has struggled to compete with its rival Sephora in the premium space. However, McKinsey states that 37% of consumers are switching retailers for better prices, a 1% increase since the first quarter of 2024. 25% of consumers also changed brands to a lower-priced option, showing a 2% increase since the first quarter. Ulta stands to gain from consumers who will want to cut costs in semi-discretionary categories, while still obtaining their desired Beauty products.

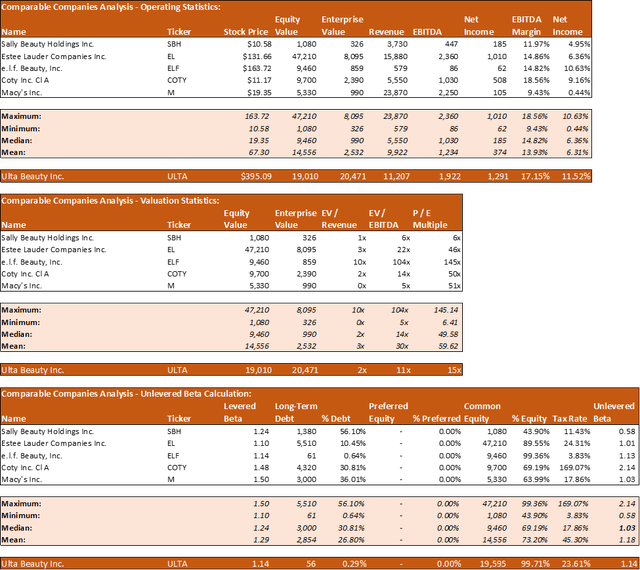

Ulta Sits At A Cheap Valuation For Optimists

As previously mentioned, Ulta still sits on the lower end of valuation for companies in the beauty industry despite posting above-average revenue, profit, and margins. For comparable companies, I chose Sally Beauty Holdings (SBH), Estée Lauder Companies Inc. (EL), e.l.f. Beauty, Inc. (ELF), Coty Inc. Cl A (COTY), and Macy’s Inc. (M). The first four companies’ primary revenue drives directly from the beauty industry, while Macy’s also offers a significant selection of Beauty products, and competes with Ulta for retail customers.

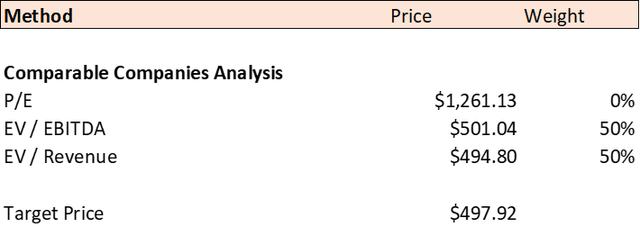

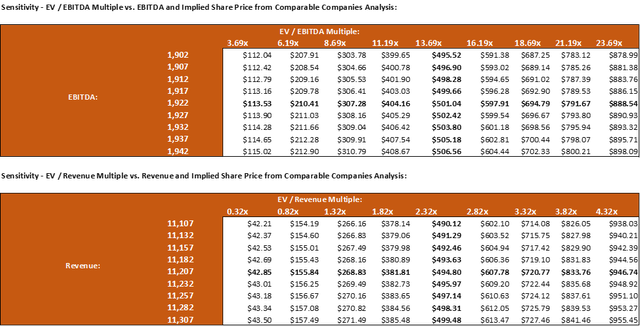

Since all of these companies generate revenue and most are profitable, I view revenue and EBITDA multiples as meaningful. I place less weight on P / E multiples, given the wide range of valuation for firms in the beauty industry. The median EV / EBITDA multiple is currently 14x. Given that Ulta’s revenue, EBITDA, and EBITDA margins all exceed the median metrics of those for the comparable public companies, I think that EBITDA multiples more in line with at least the median of the set are justified. The median EV / Revenue multiple is currently 2x. Given that Ulta’s revenue exceeds the median metrics of those for the comparable public companies, I think that revenue multiples more in line with at least the median of the set are justified. As a result, I selected an EV / EBITDA multiple of 14x and an EV / Revenue multiple of 2x and applied them to Ulta. This resulted in share prices of $501.04 and $494.80. I weight both the EV / EBITDA and EV / Revenue multiples equally to arrive at a target price of $497.92.

Company Data, MarketWatch Own Analysis

The Bear Case

Fundamental Analysis Paints A Worse Picture

While from a valuation standpoint, Ulta has a lot to gain, from a fundamental approach, the company could have a lot to lose. As a reminder, the company lowered guidance for their FY 24 outlook:

Furthermore, multiple members of management on various occasions have admitted category growth is slowing across the industry. CEO Dave Kimbell stated during Q1 earnings that growth in the beauty category will slow to the “mid-single-digit range this year barring a major economic event”. COO Kecia Steelman doubled down on this statement at Oppenheimer’s conference, stating that “category growth, it’s moderated to the mid-single digits”. As you may recall, Ulta has historically had an average growth rate of 23% over the past few years while maintaining a valuation in the range of $380 to $540. In theory, with slowing growth in the industry, a valuation on the higher side of this range certainly is not warranted.

Forecasting The Current Situation

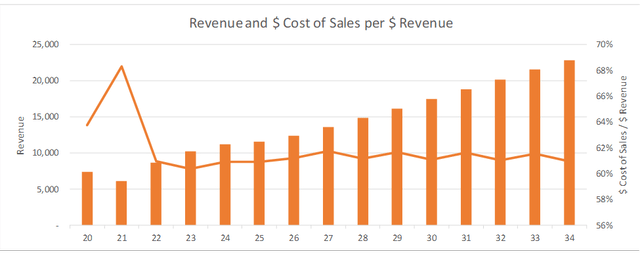

To reiterate, growth in the industry has slowed from around 20% to a future of high single-digit growth. Taking this into account, in addition to other inferences from management commentary, we can forecast what a fundamental valuation looks like:

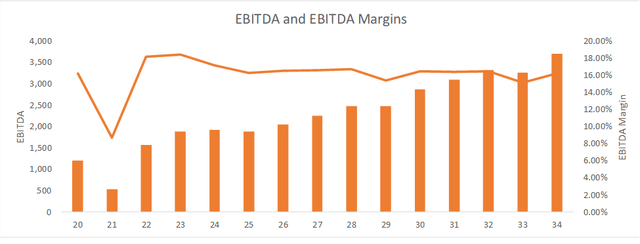

A future of high single-digit growth for Ulta leads to roughly a $23 billion revenue figure in FY 34. If we assume that profitability figures will be as management anticipates for FY 24, and that margins remain similar to how they have over the past two years, this is what EBITDA looks like for Ulta:

Finally, assuming a cost of capital in accordance with the median capital structure across firms in the Beauty industry (see comparable companies’ analysis for selected companies), we arrive at the following cash flows:

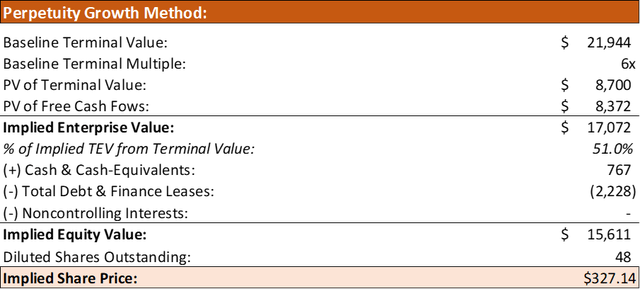

This ultimately leads to a share price significantly lower than even the current price:

As always, fundamental analysis does not always translate to actual returns, but it is an important factor to consider.

Takeaways

If you haven’t been paying attention, there are mixed signals both internally in the financials and expectations, and externally in market comparables as to what Ulta’s true share price should be. With this in mind, I strongly recommend investors hold on Ulta stock. In order to upgrade my recommendation, I would need to see any at least one of the following: Improved outlook from management, strong growth numbers from their launch in Mexico, or improved growth across the category. I could also change my recommendation to a sell if earnings miss their lowered expectations, or if a major economic event occurs that affects the industry. I say, hold for not until one of these catalysts occurs.