The Magnificence Well being Firm Q1 2024 Earnings: Sitting Fairly Or Turning Ugly? (NASDAQ:SKIN)

sdominick/E+ via Getty Images

Moats and Monopolies

Here at Moats and Monopolies, we do things a little bit differently. We write exclusively about companies that we own in our publicly shared portfolio, which beat the S&P 500 by nearly 10% in 2023.

We are generally long-only quality investors, but the boringly named Beauty Health Company (NASDAQ:SKIN) is one that has strangely fascinated us since going public, and this is the fourth article that we have now written about this rollercoaster stock. To take a look here if you are interested in our thoughts from the last quarter, i.e. Q4 2023.

In this article, we look at the good and bad that came out of the most recent earnings to see whether we still believe that there is still a multibagger opportunity, and we take a look at the start of Marla Beck’s tenure as company CEO.

Previously on ‘The little facial company that could, then couldn’t, but maybe can again’

The Beauty Health Company is a business to business provider of high end facial machines to spas and beauty parlours internationally under the brand name ‘Hydrafacial’. The business operates a classic Razor and Blade model, selling machines under the ‘Syndeo’ name and then the ‘consumables’ or blades required for them to function and deliver their service to end consumers – mostly middle class and aspirational women seeking a little luxury in their beauty regimes. In addition, the company has value add items called ‘boosters’ that customise the experience to the consumer’s liking, including celebrity endorsed options, such as those under the J.Lo / Jennifer Lopez name.

The simplicity of the model drew us in very early, but the initial excitement over its global opportunity has waned since its stock peaked at nearly $30 to free fall to recent lows of just a dollar or so. During this time, the company has grown – there are more machines installed, they have presence in luxury retail such as the world famous Harrod’s of London and LVMH (OTCPK:LVMHF) owned Sephora, and their devices have been iterated to the third version of their flagship Syndeo machine.

So why the terrible stock performance? Well, that little Syndeo machine has been rather naughty. In our original article on the company (which has not dated particularly well), we were concerned at how little such an ostensibly innovative company were spending on research and development compared to the product’s marketing, and our fears were well founded as vendors started to highlight a variety of issues with the new third generation devices. This led to the company taking the expensive but ultimately correct decision to replace units rather than repairing them, which sent the stock price cratering.

The second main reason why the company has fallen so far from its highs is that it has been terribly mismanaged. In the past couple of years, there has been an almost revolving door of new executives in the C-Suite, as several appeared to give a higher priority to partying with influencers than focusing on the operations of the company. When sales were starting to stagnate, rather than addressing it, they simply discussed their movement into new verticals and new products, which culminated with the announcement they were moving into direct to consumer and retail beauty products. Yup, they thought they were L’Oreal (OTCPK:LRLCF). Spoiler alert: They were not.

This all led to the now infamous Q3 2023 earnings report when the CEO didn’t show up and the company cancelled the analyst Q&A, instead presenting just their prepared remarks. The lack of clarity of the scale of the botched device roll out led to the stock price falling nearly two thirds in a single day. This huge drop was where we initiated a position in the company into the Moats and Monopolies Portfolio at a cost basis of $1.45.

Our take on Q1 Earnings

The new leadership team could have legs. We have written various times across our articles about the high levels of turnover in the C-Suite. Marla Beck, as discussed in our last one, has a strong background in the beauty and cosmetics space, having founded and led a retail chain called Bluemercury that would ultimately be sold to Macy’s for $210 million. We believe that the ultimate exit strategy for Beauty Health is to become an operationally profitable leader in its cosmetic niche and then to be sold, so she sounded great when announced as interim, and her permanent appointment feels like a good fit. She appears to have a clear three-pronged plan including furthering sales, improving the operations of the company and reining in spending. Let’s break each of those down.

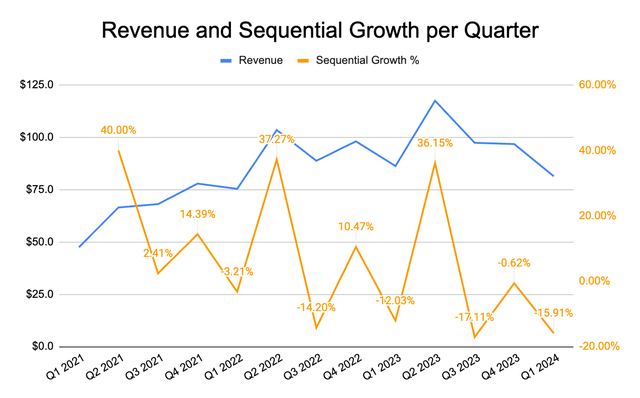

1) Sales were down. Sequentially and year on year. Sequentially isn’t a concern at all. As one can see from the chart below, revenues dip each Q1 and there is growth in each Q2. Spikey revenues are fine as long as the pattern is up and to the left. However, that is not happening at the moment, and the year on year Q1 sales drop off is a concern. The nearly 16% drop year over year for the 1st quarter is the highest since going public. It will be highly instructive to see if revenue bounces back in Q2 to around the $120 million mark it hit last year. It is still too early to judge Beck’s performance on sales growth, of course, but the company can hardly be said to be firing on all cylinders, and she has work to do.

2) Operations need time to improve, and the appointment of Sheri Lewis a few weeks ago as the new COO with a focus on the company’s supply chain, seems a positive one. Lewis held a similar role at Avantor, a Fortune 500 biotech company as well as a decent 12 year stint as VP of Global Operations at Medtronic, a med tech company. Genuinely, this looks to be a really good appointment, and we believe that the pair of them could well have the pedigree and experience needed to finally move this company forward.

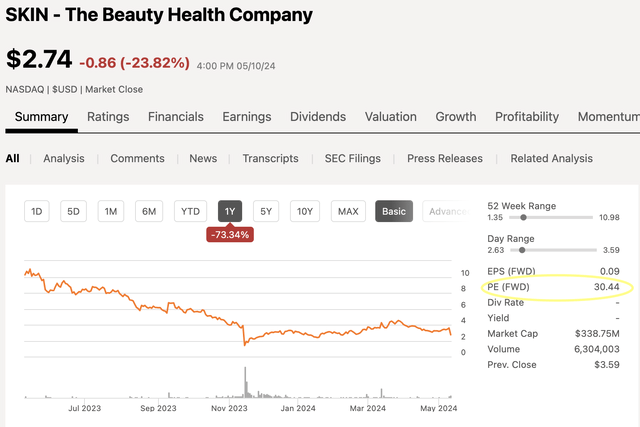

3) Spending seems to be slowly getting under control. While cost of goods sold was up a little year on year, operating expenses were down. Better still, sales and marketing and general administrative both fell and research and development went up. This is in our view a really positive move. Management in the last quarter implied the Syndeo issues might be nearing a turning point – stating that they would once again focus sales on Syndeo 3 and not the patched up refurbs of older models that had acted as a temporary band aid. If this is indeed the case, and gross margins can rise again to previous levels, there may finally be operating leverage and profitability on the horizon – the company now features an actual forward PE on Seeking Alpha!

What we are watching moving forward

There are 3 main things that we will be watching with interest in the next couple of quarters.

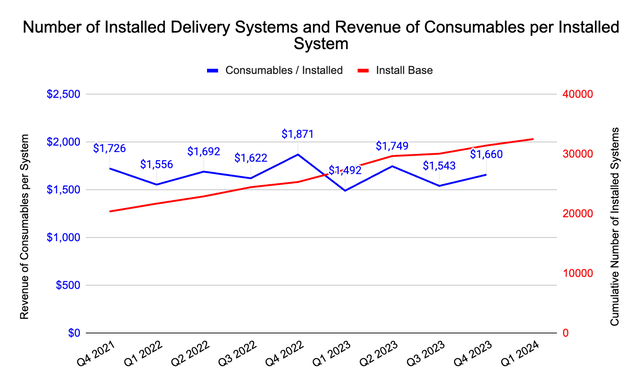

First, is a metric that isn’t from management but one we’ve created, which we call ‘Consumables per Installed System’ – found by simply dividing the total reported number of installed machines and by quarterly consumables revenue. As one can see in the chart below, the install base has been continuing to grow but the amount of sales generated by each unit has remained pretty much flat. This could be read as either positive or negative. On one hand, the machines may not be generating increasing revenue over time for both Beauty Health and its vendors, which could render them less attractive to future potential buyers or possibly highlight an efficiency bottleneck in the devices. On the other hand, despite the lagging effect of inflationary pressures on discretionary spending, these middle class consumers are still coming to get their regular facial, which could mean potential sales increases during more stable economic environments or the stickiness of the product. Either way, we will be looking to ensure that the total installed systems continue to go up and the revenue generated for each remains at least stable.

Second, we will be watching for quantifiable evidence of increased operational efficiencies that are presumably the top priority of Sheri Lewis in her role overseeing supply chains. New devices sold must be fully operational and the company needs to restore their reputation as well as ensure no more money is wasted writing off equipment or holding spares on the inventory line of the balance sheet in case replacements are needed. The overall gross margins must return to previous levels around the 70% mark, particularly as consumables become a larger percentage of total revenue.

Third, capital allocation. We do not expect to see unprofitable companies buying back stock when they still haven’t fully proven that they can be consistently and reliably free cash flow positive. This past quarter saw cash on hand continue to go down as the company burns through their IPO money; however, we did the see the first reduction in long term debt liabilities as convertible debt was changed to new stock – you may notice that the basic share count has gone down as a result of buybacks whilst the diluted share count has increased. Depending on what happens to the share price, this could be a good move, but either way, it is good to see the company lowering its existential threat of bankruptcy by finally bringing debt down.

Final words

The company is certainly at the far end of the risk reward spectrum and not for everyone. If you do decide to join us, note that the stock is volatile and regularly jumps tens of percent up or down post earnings.

Digging a little into recent 10-Qs, there is increasing litigation against at least one competitor regarding possible patent infringement on rival devices, and other cases against companies creating cheaper 3rd party options for Beauty Health’s proprietary consumables (the blades, of the model). As our thesis largely depends on this recurring revenue stream scaling over time, we will dig into these legal cases in the next quarterly update, when hopefully we have fewer C-Suite changes to write about!

We hold steady on our possibly controversial Strong Buy rating post Q1 earnings, and believe that there is a decent global opportunity for the company, especially now that they seem to have the right people in place to deliver the product in an efficient no-frills, pragmatic way.

Time will tell. Looking forward to respectful and constructive ideas and perspectives below the line. We’ll see you there!