E.L.F. Magnificence Inventory: Let Your Winners Run (NYSE:ELF)

Philippe TURPIN/Photononstop via Getty Images

ELF Stock Suffered A Bear Market

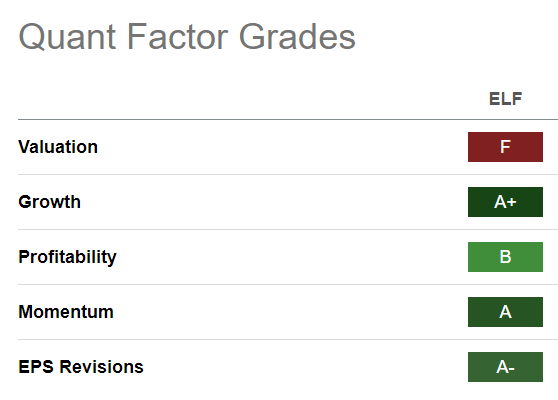

e.l.f. Beauty, Inc. (NYSE:ELF) investors suffered a steep bear market decline between March and April 2024, as beauty investors bailed following Ulta Beauty’s (ULTA) negative commentary in early April. Accordingly, Ulta warned of potentially “slowing growth” attributed to “rising credit card debt and student loan repayments among consumers.” Consequently, it intensified selling pressure on ELF, given its focus on debt-laden Gen Z and value-conscious consumers. The selloff is justified, as ELF stock is rated with an expensive, high-growth premium (“F” valuation grade) as the market possibly assessed heightened execution risks.

ELF Quant Grades (Seeking Alpha)

Despite the recent bear market plunge, ELF is still rated at a premium compared to its consumer staples peers. However, ELF stock’s “A+” growth grade underscores Wall Street’s confidence in sustaining its growth cadence. Bolstered by a solidly profitable model, buying momentum has remained incredibly resilient (“A” momentum grade), notwithstanding the recent pullback. In other words, I assessed ELF seems to be bottoming out, as its long-term growth story in the cosmetics and beauty space is far from finished. Does it make sense?

While Ulta Beauty was careful with its commentary that affected e.l.f. Beauty, L’Oréal S.A. (OTCPK:LRLCF) delivered solid results in its recently reported quarter. Accordingly, L’Oréal’s Q1 earnings release surpassed estimates, “driven by strength in Europe and North America.” Accordingly, the company posted “better-than-expected performance in North America, where like-for-like sales rose by 12%.” Therefore, the risks of a structural decline in the beauty space have likely been lowered, mitigating further downward volatility in peers like ELF.

Despite that, the experience hasn’t been consistent, as seen with Estée Lauder (EL). Estée Lauder faces intense competitive pressures “from both established and emerging beauty brands.” As a result, EL stock has continued to suffer as investors gauged its structural headwinds in the US market, “where it has been losing market share.”

e.l.f. Beauty Has Executed Well To Gain Share

Given the significant gains made by e.l.f. Beauty, ELF has demonstrated its innovation capabilities and hybrid supply chain competencies. They have rapidly helped the company gain market share while sustaining a profitable business model (“B” profitability grade). Furthermore, focusing on delivering a solid value proposition to its Gen Z customers has been executed with remarkable precision, driving further gains.

In addition, e.l.f. Beauty has also identified further market share gains in skincare, where it remains under-penetrated. The recent acquisition of Naturium helps to expand e.l.f. Beauty’s TAM, reaching into the more premium skincare range, complementing e.l.f. SKIN’s lower-priced strategies. As a result, e.l.f. Beauty can continue to justify its high-growth premium to ELF investors. The company believes its expansion in the skincare category would broaden its ability to “provide high-quality beauty products accessible to all consumers.” Therefore, ELF’s core focus of delivering value to its customers has not shifted, lowering assessed execution risks.

There is palpable optimism surrounding e.l.f. Beauty’s long-term growth prospects. However, ELF’s digital presence in partnership with TikTok (BDNCE) shop exposes it to heightened geopolitical risks. However, I didn’t assess a material near-term impact on TikTok’s legitimacy to operate in the US, as TikTok and the US government fight their cases in court. In contrast, it demonstrated how quickly ELF can execute its digital strategy and garner significant online reception and momentum from its target market. ELF’s competent execution underscored its ability to appeal to its target market, capture share, and deliver rapid revenue and profitability growth.

ELF’s High-Growth Premium Demands Solid Execution

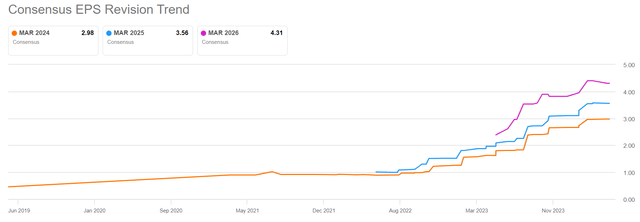

ELF earnings estimates revisions (Seeking Alpha)

As a result, it has led to significant upward revisions in earnings estimates, underscoring the company’s growth opportunities. Despite that, questions must still be asked whether ELF can sustain its expensive valuation if growth potentially normalizes in the medium term.

ELF stock is valued at a forward adjusted earnings multiple of 47.4x, well above its peers’ median of 23.1x. Therefore, an unanticipated slowdown or poor execution could lead to a steep downward valuation de-rating, suggesting investors must watch ELF’s market developments closely.

In addition, the company has expanded internationally, although the cadence is measured and more cautious. ELF management believes that a market-by-market approach is better suited to establishing its presence and gaining market share by replicating the domestic playbook.

Therefore, investors must be careful about expecting e.l.f. Beauty can gain share rapidly in global markets. The company’s more cautious go-to-market demonstrates a deliberate approach to winning over loyal consumers is necessary, which could slow down its GTM motion to meet the market’s high-growth expectations.

Is ELF Stock A Buy, Sell, Or Hold?

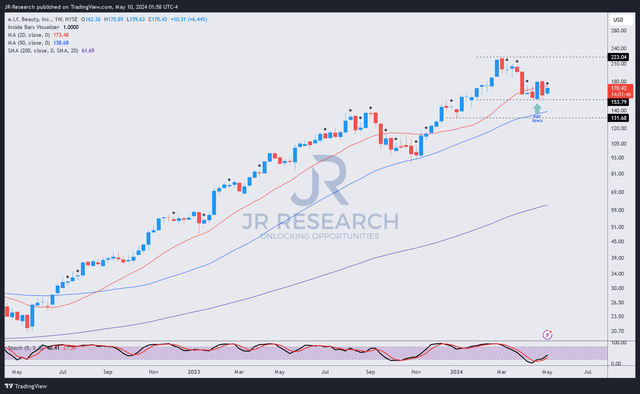

ELF price chart (weekly, medium-term) (TradingView)

Notwithstanding the caution highlighted earlier, ELF’s price chart hasn’t demonstrated sell signals, suggesting long-term ELF investors can consider holding on to their substantial gains.

The bear market decline from ELF’s March 2024 highs has leveled off as ELF stock consolidated in late April. ELF buyers seemed to have defended the stock from further downside volatility, helping it to potentially regain its upward momentum.

As a result, I assessed that high-conviction ELF buyers might find the current levels attractive, as ELF’s medium- and long-term uptrend remains intact. Consequently, the long-term bias on ELF stock suggests an uptrend continuation thesis is appropriate.

However, investors uncomfortable with ELF’s high-growth premium should consider looking at other less expensive stocks.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.